Turning Your Home Energy Vision into Affordable Reality

Upgrading your home with energy-efficient systems and renewable energy technologies in 2025 is a significant undertaking, but one that promises long-term savings, increased comfort, and a smaller environmental footprint. With a complex web of federal tax credits, new IRA rebate programs, and various state and local incentives available, strategic planning is essential to maximize your financial benefits and make these upgrades as affordable as possible. This guide provides a strategic framework for planning your home energy upgrades to make the most of the incentives available in 2025.

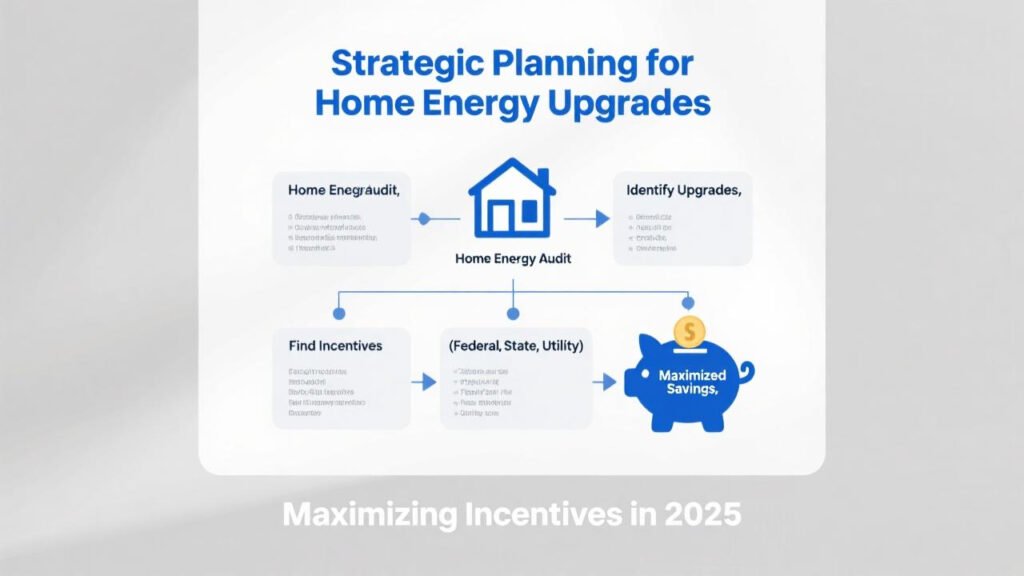

Step 1: Start with a Comprehensive Home Energy Audit

Before diving into specific upgrades, understand your home’s current energy performance.

* Why it’s Crucial: A professional home energy audit (which itself may qualify for a federal tax credit of up to $150 ) will identify where your home is losing the most energy and which improvements will yield the greatest savings and comfort. This provides a data-driven roadmap for your upgrades.

* Outcome: You’ll receive a prioritized list of recommendations, from basic air sealing and insulation to larger projects like HVAC replacement or window upgrades.

Step 2: Research All Available Incentives – Federal, State, Local, and Utility

Once you have an idea of potential upgrades, thoroughly research all financial incentives you might be eligible for.

* Federal Tax Credits:

* Residential Clean Energy Credit: 30% for solar, battery storage, geothermal (uncapped for most).

* Energy Efficient Home Improvement Credit: 30% for insulation, windows, doors, efficient HVAC, electrical panel upgrades, with annual limits (e.g., $2,000/year for heat pumps, $600/year for windows, $1,200/year general cap for envelope components, $3,200 overall annual cap).

* Federal IRA Rebate Programs (HOMES & HEAR):

* Check your State Energy Office for the status of the HOMES (whole-home efficiency, all incomes, LMI enhanced) and HEAR (electrification for LMI households, point-of-sale) rebate programs. These can offer thousands of dollars in upfront savings.

* State and Local Incentives:

* Use the DSIRE database (dsireusa.org) to find state-specific tax credits, rebates, property tax exemptions, and loan programs.

* Check your local utility company’s website for rebates on specific equipment (e.g., smart thermostats, heat pumps, EV chargers).

* Manufacturer Rebates: Don’t forget to look for rebates offered directly by manufacturers of appliances or equipment.

Step 3: Understand Eligibility Criteria and Annual Limits

This is where strategic planning becomes critical, especially for the Energy Efficient Home Improvement Credit, which has annual limits.

* Annual Caps: Remember the $2,000 annual cap for heat pumps/HPWHs/biomass, the $600 cap for windows, the $500 cap for doors (max $250/door), and the $1,200 general cap for building envelope components (insulation, air sealing) under the Energy Efficient Home Improvement Credit. The overall annual limit for this credit is $3,200.

* No Lifetime Limit (for Energy Efficient Home Improvement Credit): You can claim these annual maximums each year you make eligible improvements through 2032.

* No Cap (for most Residential Clean Energy Credit items): The 30% credit for solar, batteries (≥3kWh), and geothermal has no dollar cap (except for fuel cells).

* Efficiency Requirements: Ensure the products you choose meet the specific ENERGY STAR or other efficiency standards required for each incentive (e.g., ENERGY STAR Most Efficient for heat pumps and windows to claim the 25C tax credit in 2025).

* Income Eligibility: The HEAR rebates and enhanced HOMES rebates are income-restricted (based on Area Median Income).

Step 4: Prioritize and Sequence Your Upgrades Strategically

Based on your energy audit, available incentives, and budget, plan the order of your projects to maximize both energy savings and financial benefits.

- “Whole-House” Approach: Address foundational issues first.

- Air Sealing and Insulation: These often provide a high ROI and are relatively inexpensive. They also make subsequent HVAC upgrades more effective as your heating/cooling system won’t have to work as hard. These fall under the $1,200 annual building envelope component limit for the tax credit.

- Leverage Annual Tax Credit Limits:

- Example Strategy Over Multiple Years:

- Year 1: Install a qualifying heat pump (claim up to $2,000 tax credit) and conduct a home energy audit (claim up to $150 tax credit). If you also do significant insulation work this year, you can claim up to $1,200 for that, staying within the $3,200 overall annual cap.

- Year 2: Replace windows with ENERGY STAR Most Efficient models (claim up to $600 tax credit) and upgrade exterior doors (claim up to $500 tax credit).

- Year 3: Install solar panels and battery storage (claim the 30% Residential Clean Energy Credit, which has no cap for these items and is separate from the annual limits of the other credit).

- Example Strategy Over Multiple Years:

- Align with IRA Rebate Program Rollout:

- If you qualify for HEAR or HOMES rebates, coordinate these with your projects. HEAR rebates are point-of-sale, so they provide upfront cost reduction. You may need to work with program-approved contractors.

- Remember, for some IRA rebates, you cannot purchase or install equipment before a rebate is reserved.

- Consider Project Dependencies:

- An electrical panel upgrade (up to $600 tax credit ) might be necessary before installing a heat pump, EV charger, or extensive new electric appliances. Plan this accordingly.

Step 5: Work with Qualified, Incentive-Aware Contractors

- Get Multiple Quotes: For any major project, obtain at least three quotes from qualified installers.

- Discuss Incentives: Choose contractors who are knowledgeable about federal, state, and local incentives. They can often help you select qualifying equipment and navigate the application processes.

- Ensure Proper Documentation: Your contractor should provide detailed invoices and documentation specifying the make, model, and efficiency ratings of installed equipment, which you’ll need for claiming credits and rebates.

Step 6: Meticulous Record-Keeping

- Save Everything: Keep copies of all purchase receipts, installation contracts, paid invoices, manufacturer certifications (e.g., AHRI certificates for HVAC, ENERGY STAR labels), photos of installed equipment, and any rebate applications or approvals.

- Tax Forms: You’ll need IRS Form 5695 to claim the federal tax credits.

A Coordinated Approach to a More Efficient Home

Maximizing the financial benefits of home energy upgrades in 2025 requires more than just choosing efficient products; it demands strategic planning. By starting with a home energy audit, thoroughly researching all available incentives, understanding eligibility rules and annual limits, and thoughtfully sequencing your projects, you can significantly reduce your out-of-pocket costs. Layering federal tax credits with the new IRA rebate programs and any state or local offers can make even substantial upgrades surprisingly affordable. Consult with energy professionals and tax advisors to create a personalized plan that transforms your home into a model of efficiency and savings.