Solar Loan vs. Lease: Which Saves You More Money in the Long Run

For most homeowners, a solar loan is the clear winner in 2025. Data from Zillow shows owned solar systems increase home value by an average of 6.9%, a premium of over $29,000 for a median-valued home. A loan also secures the 30% federal tax credit, an incentive that expires permanently after December 31, 2025. In contrast, a solar lease adds no home value and creates significant, costly complications when you sell your property. This guide breaks down the data-backed reasons why one option builds wealth while the other creates a long-term liability.

- Solar Loan vs. Lease: Which Saves You More Money in the Long Run

- Solar Loan vs. Lease: The Fundamental Difference is Ownership

- The Financial Deep Dive: A 25-Year Cost & Value Comparison

- The Home Sale Dilemma: Why a Leased System is a Closing Table Nightmare

- Making the Right Choice for Your Financial Goals

- Common Mistakes & Solutions When Choosing Solar Financing

- The Final Verdict: Why a Solar Loan is the Smarter Investment in 2025

- Frequently Asked Questions (FAQ)

Solar Loan vs. Lease: The Fundamental Difference is Ownership

Before diving into the complex numbers, it’s crucial to understand the one core principle that separates a solar loan from a solar lease: ownership. This single distinction is the root cause of all the financial and logistical differences you will face over the next 25 years.

Solar Loan: You Own the Asset

When you finance with a solar loan, you are borrowing money to purchase a solar panel system outright. From the moment it’s installed, you are the owner. The system becomes a fixture of your property, a tangible asset just like a remodeled kitchen or a new roof. You are responsible for the system, but you also reap all of its financial rewards. Once the loan is paid off, the electricity it produces is yours, free and clear, for the remainder of the system’s 25+ year lifespan.

Solar Lease/PPA: You Rent the Equipment

With a solar lease or a Power Purchase Agreement (PPA), you are simply a renter. You sign a long-term contract, typically 20 to 25 years, to pay a third-party company a monthly fee for the right to use the power their system generates on your roof. The solar company owns and maintains the equipment for the entire duration of the agreement. You never build equity, and you never own the panels. At the end of the term, the company can remove them, or you may have the option to buy the used system at its depreciated market value.

This fundamental difference—asset versus rental—is the key to understanding why the financial outcomes of these two paths diverge so dramatically.

The Financial Deep Dive: A 25-Year Cost & Value Comparison

A smart financial decision requires looking beyond the initial offer and analyzing the long-term implications. While a lease’s promise of “no money down” can be tempting, a comprehensive 25-year analysis reveals that a solar loan delivers overwhelmingly superior financial value through home equity, tax incentives, and lifetime savings.

The $29,000+ Advantage: Ownership, Equity, and Your Home’s Value

The single most powerful financial argument for choosing a loan is the immediate and substantial value it adds to your property.

- Owned Systems (via Loan/Cash): The evidence is conclusive. A 2025 data study from Zillow, which analyzed hundreds of home sales, found that properties with owned solar panel systems sell for an average of 6.9% more than comparable homes without solar. For a U.S. home with a median value of around $420,000, that 6.9% premium translates to an additional $28,980 in home equity. This value increase often exceeds the net cost of the system itself, creating an immediate positive return on investment. Research from the U.S. Department of Energy’s National Renewable Energy Laboratory (NREL) further supports this, finding that every $1 you save on your annual energy bills can increase your home’s value by $20.

- Leased Systems: A solar lease adds zero tangible asset value to your home. Because the panels are the personal property of the leasing company, they are not considered a permanent fixture of your home. Real estate appraisers do not include leased systems in a home’s valuation, meaning you gain no equity from having them on your roof. Instead of an asset, the lease is viewed as a liability that must be transferred to a new buyer.

The Lifetime Cost: Unpacking the Numbers

The initial monthly payment is only a tiny fraction of the story. The true cost of any financing option is the total amount you pay over its entire lifetime. Here, the fixed, predictable nature of a loan stands in stark contrast to the escalating costs often hidden within a lease.

A solar loan functions like any other standard loan: you have a fixed interest rate and a fixed monthly payment. Once the loan term is complete (typically 10 to 20 years), your payments stop, and you enjoy decades of free electricity. Average interest rates for dedicated solar loans from top providers can range from around 3.95% to over 7%, depending on the lender, your credit, and market conditions.

A solar lease, however, contains a critical feature that many homeowners overlook: the escalator clause. Most lease contracts include an annual payment increase of 1% to 5%. This is not a simple interest calculation; it compounds year after year. A common escalator of 2.9% might seem small, but over a 25-year lease term, it will cause your monthly payment to nearly double. This mechanism is designed to erode your savings over time, and in some cases, can cause your lease payment to eventually surpass the cost of electricity from your local utility.

The table below models a typical 7.2 kW system to illustrate the stark difference in long-term cost and value.

| Metric | Solar Loan (Ownership) | Solar Lease (Rental) | Data-Driven Insight |

|---|---|---|---|

| Average System Cost | $26,004 (financed) | $0 Upfront | Loan cost reflects the purchase of a real asset. |

| Federal Tax Credit (30%) | $7,801 Credit to You | $0 (Credit goes to the leasing company) | This is a direct, non-negotiable financial loss of thousands of dollars with a lease. |

| Net Cost After Credit | $18,203 | N/A (You never own it) | Ownership provides a clear path to a lower net cost. |

| Monthly Payment (Year 1) | ~$121 (20-yr loan at 5.99%) | ~$120 (example starting payment) | Payments appear similar at first, which is a key sales tactic for leases. |

| Monthly Payment (Year 25) | $0 (Loan is paid off) | ~$245 (with 2.9% annual escalator) | The escalator clause doubles the lease payment, while the loan payment is eliminated. |

| Total Payments (25 Years) | ~$29,040 | ~$44,100 | The lease costs over $15,000 more over the system’s life. |

| Home Value Increase | +$29,000 (avg. 6.9% premium) | $0 | A loan builds equity; a lease adds a liability. |

| Net Financial Outcome | +$27,961 (Value increase + savings – cost) | -$44,100 (Total payments with no equity) | The financial gap between owning and leasing is over $72,000 in this model. |

The $9,000+ Incentive You Can’t Ignore: The Federal Solar Tax Credit

The Residential Clean Energy Credit is one of the most powerful financial incentives ever offered for solar energy. It allows you to deduct 30% of your total system cost—including panels, equipment, and labor—directly from your federal income taxes. For an average system costing around $29,000, this translates to a credit of $8,700.

This massive incentive is only available to homeowners who own their system, either through a cash purchase or a solar loan. If you lease, the multi-thousand-dollar credit goes directly to the leasing company, and you see none of it.

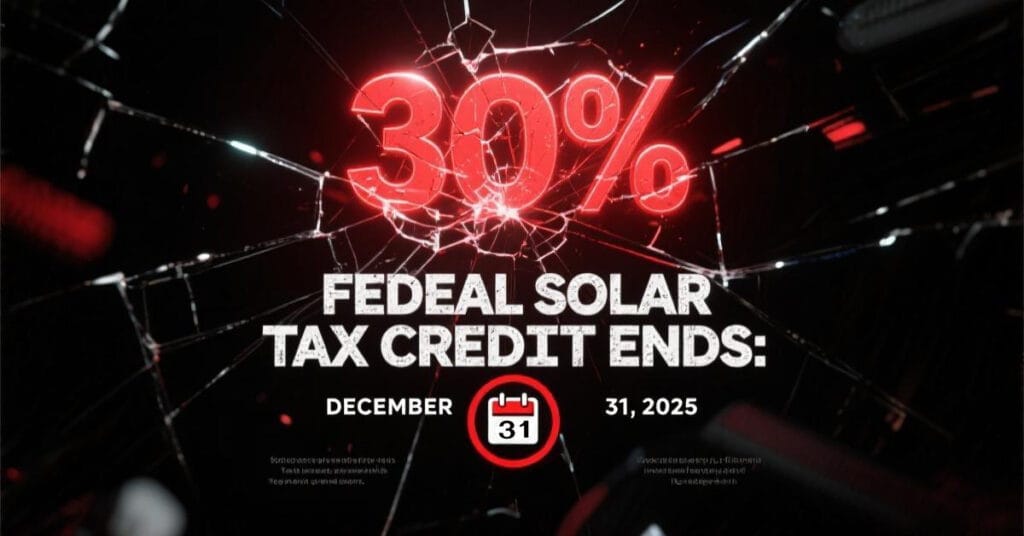

CRITICAL DEADLINE: This is not a permanent incentive. As part of the “One Big Beautiful Bill Act” signed into law on July 4, 2025, the 30% residential solar tax credit will be completely eliminated for any system not installed and placed in service by December 31, 2025. There is no phase-down period. On January 1, 2026, this incentive disappears forever. This creates an urgent, non-negotiable deadline. Choosing a lease or waiting past 2025 means actively choosing to forfeit thousands of dollars in tax savings.

The Home Sale Dilemma: Why a Leased System is a Closing Table Nightmare

For many homeowners, the decision to go solar is a long-term investment. But life is unpredictable, and your ability to sell your home smoothly is a critical aspect of your financial freedom. This is where the difference between a loan and a lease becomes most painful.

Selling with an Owned System

Selling a home with an owned solar system is straightforward. It is a valuable feature that you market to potential buyers. As established, it increases your home’s sale price by an average of 6.9% and can help it sell up to 20% faster, according to data from Zillow and NREL. The system is part of the property, and the transaction proceeds like any other home sale.

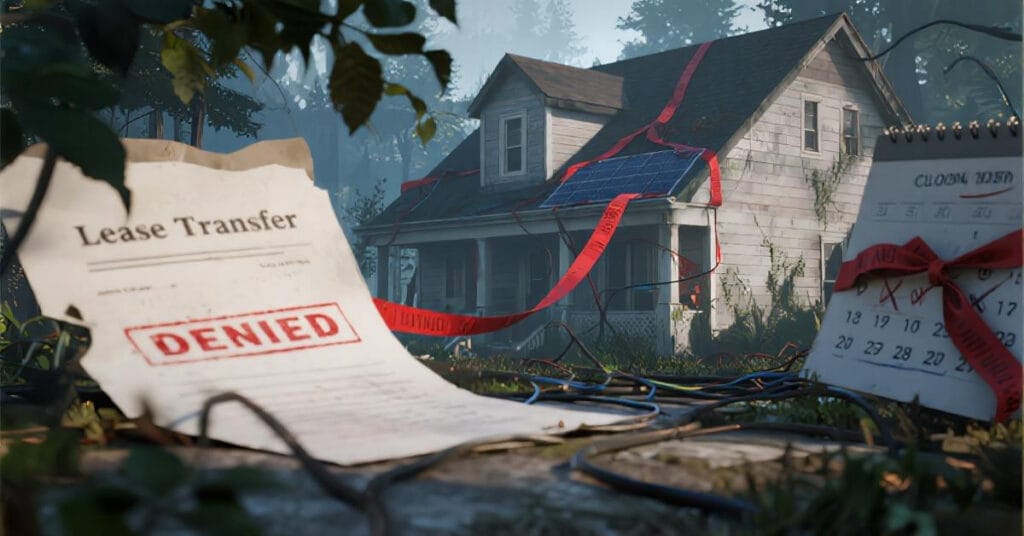

Selling with a Leased System

Attempting to sell a home with a leased solar system introduces a third party—the leasing company—into your real estate transaction, creating significant friction, delays, and risk.

- The Buyer Qualification Hurdle: The potential buyer of your home must be separately approved by the solar company to assume the remainder of your 20 or 25-year lease. This is not a simple paperwork transfer. The solar company runs its own credit check and has its own underwriting criteria, which can be much stricter than a mortgage lender’s. A buyer who is fully approved for a home loan can still be denied the lease transfer, potentially killing the entire deal.

- The Debt-to-Income (DTI) Impact: Lenders view the monthly solar lease payment as a recurring debt. This payment is added to the buyer’s other obligations (car loans, credit cards) when calculating their debt-to-income ratio. This added debt can reduce the buyer’s overall borrowing power or, in some cases, push their DTI too high to qualify for the mortgage in the first place.

- Crippling Closing Delays: The lease transfer process is notoriously slow and bureaucratic. It requires extensive paperwork and can take an additional 30 to 60 days to complete, far exceeding the typical due diligence period in a real estate contract. These delays can cause immense stress and can lead to buyers walking away if deadlines are missed.

- Investor and Business Entity Restrictions: A significant portion of real estate is purchased by investors or through business entities like LLCs for liability protection. Most major solar leasing companies refuse to transfer leases to any business entity, requiring an individual person to assume the contract. This policy immediately disqualifies a large pool of potential buyers for your home.

- The Buyout Trap: If a buyer refuses to take on the lease or is denied the transfer, the seller is often left with only one option to save the sale: buy out the remainder of the lease contract in full. This can cost $15,000 to $20,000 or more, instantly erasing years of electricity savings and turning the “free solar” promise into a massive financial loss.

Making the Right Choice for Your Financial Goals

The data clearly points to one superior option, but understanding how it aligns with your specific goals can solidify your decision.

- For the “Pragmatic Investor”: Your goal is the best possible return on investment. The data is unequivocal. A solar loan allows you to purchase an asset that adds an average of 6.9% to your home’s value, provides a 30% tax credit, and delivers decades of free energy after payback. A lease is a rental agreement with compounding costs and zero equity. The choice is clear.

- For the “Budget-Conscious Adopter”: The $0-down offer of a lease is its primary appeal, but it’s a financial illusion. The compounding escalator clause is designed to eat away at your savings over time. A solar loan, especially when comparing multiple offers on a marketplace, provides a fixed, predictable payment that is often comparable to or better than a lease payment, while unlocking thousands in equity and tax credits.

- For the “Future-Proof Homeowner”: You value control and energy independence. Ownership through a loan is the only path that delivers this. You own the asset, you control the equity it builds, and you control the process if you ever decide to sell your home. A lease forces you to cede that control to a third-party corporation for a quarter of a century.

The best way to ensure you’re making the smartest financial choice is to see all your options. A marketplace like EnergySage allows you to compare multiple, pre-vetted loan and cash offers from qualified installers, ensuring transparency and the best possible value.

Common Mistakes & Solutions When Choosing Solar Financing

Navigating the solar financing landscape can be tricky. Here are three common mistakes to avoid.

Mistake 1: Focusing Only on the First Monthly Payment

- The Problem: Homeowners are often shown an attractive Year 1 lease payment and ignore the escalator clause that increases it annually.

- The Solution: Always demand a full 25-year payment schedule from any lease provider. Calculate the total cost of payments over the entire term and compare that figure to the total cost of a loan. The initial payment is marketing; the total cost is reality.

Mistake 2: Underestimating the Home Sale Complexity

- The Problem: Salespeople may downplay the difficulty of transferring a lease, suggesting it’s a simple process.

- The Solution: Before signing any lease, ask the company for their official lease transfer packet. Review the exact timeline, the credit score required for a new buyer (most require 680+), and the full buyout cost schedule for every year of the contract. The complexity of this document compared to the simplicity of selling an owned asset will be revealing.

Mistake 3: Taking the First Offer You Get

- The Problem: Whether it’s a loan or a lease, accepting the first offer you receive almost guarantees you are overpaying. Without competition, there is no incentive for companies to offer their best price.

- The Solution: The single most effective way to ensure a fair price is to make installers compete for your business. Use an unbiased, third-party marketplace to receive multiple quotes for both the solar system and the financing. This competitive pressure is proven to lower costs for consumers.

The Final Verdict: Why a Solar Loan is the Smarter Investment in 2025

The evidence is overwhelming. When you choose a solar loan, you are making an investment in a tangible asset that increases your home’s value by an average of 6.9%. You gain access to a 30% federal tax credit worth thousands of dollars—an incentive that disappears forever after 2025. You build equity, achieve greater energy independence, and secure decades of free electricity after the loan is paid.

A solar lease offers none of these lasting benefits. Instead, it saddles you with a 25-year rental agreement with escalating payments that complicates one of the biggest financial transactions of your life: selling your home. The choice isn’t just about monthly payments; it’s about building wealth versus renting.

Don’t leave money on the table or risk your future financial flexibility. To get transparent, competitive quotes for solar loans from top-rated installers in your area before the 2025 tax credit deadline, get started on the EnergySage Marketplace today.Ultimate Guide to Solar Power Costs in 2025: Seize the Last Chance for the 30% Federal Tax Credit

Frequently Asked Questions (FAQ)

Is it better to get a solar loan or a solar lease in 2025?

For the vast majority of homeowners, a solar loan is significantly better. It allows you to own the system, which increases your home's value by an average of 6.9% and makes you eligible for the 30% federal tax credit. A lease offers neither of these critical financial benefits and can make selling your home much more difficult.

How much does an owned solar system really increase home value?

According to a 2025 data study by Zillow, homes with owned solar panels sell for 6.9% more on average than comparable homes without them. For a median-valued home, this can mean an increase of over $29,000, often providing an immediate return on your investment.

What happens to the 30% federal solar tax credit after 2025?

The 30% Residential Clean Energy Credit will be completely eliminated for systems installed after December 31, 2025.This was signed into law on July 4, 2025. There is no gradual phase-out. To claim the credit, your system must be owned (via cash or loan) and fully operational by the end of 2025.

Why is selling a house with a solar lease so difficult?

It's difficult because the buyer must independently qualify to take over your 20-25 year lease agreement, a process that can take 30-60 days and has stricter credit requirements than many mortgages. The lease payment also increases the buyer's debt-to-income ratio, potentially disqualifying them for their home loan. If the transfer fails, the seller may have to pay tens of thousands to buy out the lease.

What is a solar lease "escalator clause" and why is it bad?

An escalator clause is a term in most solar lease contracts that increases your monthly payment by a set percentage each year, typically 1-5%.This increase compounds annually, meaning a 2.9% escalator can nearly double your payment over 25 years.It erodes your long-term savings and can make your solar payment more expensive than utility power in later years.