The national average installation cost for a typical 11-kilowatt (kW) residential solar system in 2025 is between $27,720 and $29,970 before any incentives are applied,based on data from thousands of quotes compiled by authoritative sources like EnergySage and NerdWallet.

After claiming the 30% federal tax credit, this figure drops significantly, with the net cost expected to be between $19,404 and $20,979.

COUNTDOWN: The 30% Federal Residential Solar Tax Credit Will Permanently End on December 31, 2025

The true solar power cost is more than just a number; it’s a major financial decision wrapped in questions about value, feasibility, and risk. This guide provides a transparent, comprehensive breakdown of all expenses for 2025. We go beyond simple price tags to reveal the hidden costs, long-term risks, and, most importantly, how to secure the 30% federal tax credit—a saving of approximately $9,000 on average—before it permanently disappears for homeowners after December 31, 2025.

For American homeowners considering a switch to solar, 2025 is a pivotal year filled with both opportunity and extreme urgency. On one hand, the cost of solar systems has dropped significantly over the past decade. On the other hand, a key incentive that can save you thousands of dollars—the federal Residential Clean Energy Credit, worth 30% of the total system cost—has entered its final countdown and will be completely eliminated after December 31, 2025, with no phase-out period.

1. What Is the Real Cost of Solar Power in 2025?

First, let’s answer the core question: how much does it actually cost to install a home solar system?

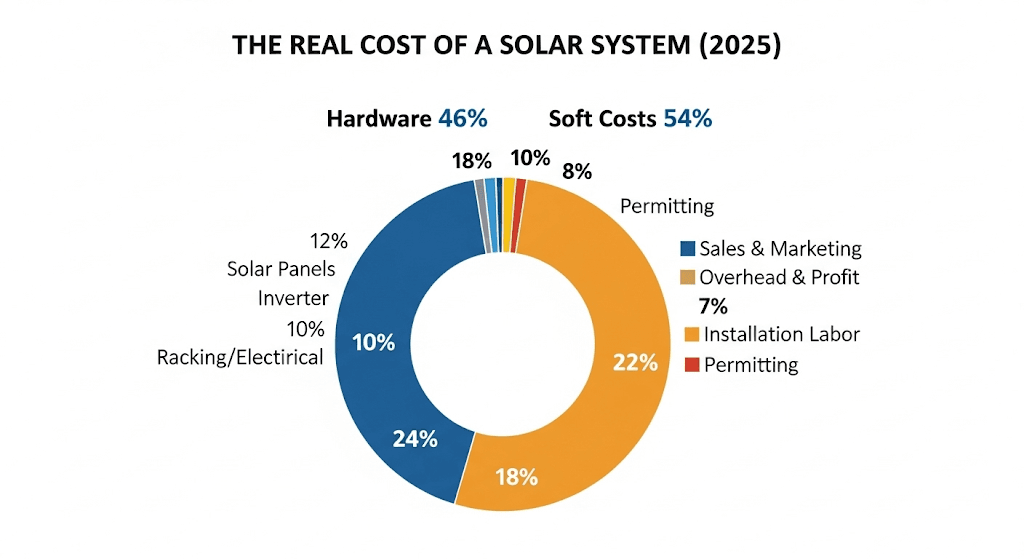

Cost Breakdown: Why Is the Total Price Much Higher Than Just the Panels?

Many homeowners are surprised to find that the final quote is much higher than the hardware price they imagined. This is because the solar panels themselves account for only a small fraction of the total cost. According to a detailed breakdown from the National Renewable Energy Laboratory (NREL), the cost structure is roughly as follows 6:

Hardware Costs (approx. 46%)

- Solar Panels: 12%

- Inverter: 10%

- Racking & Electrical Equipment: 12%

- Supply Chain Costs & Taxes: 12%

Soft Costs (approx. 54%)

- Sales & Marketing: 18%

- Overhead & Profit: 22%

- Installation Labor: 7%

- Permitting & Interconnection Fees: 8%

This clearly shows that more than half of the expense comes from “soft costs.” This is also why using competitive quote platforms like EnergySage can often lead to lower prices, as they help installers reduce their sales and marketing expenses.6

Key Cost-Influencing Factors

Your final price will vary significantly based on several key factors:

Geographic Location: The number of peak sun hours, labor costs, and incentive policies vary dramatically from state to state, directly impacting system size and final price.8

System Size (kW): The more electricity your home uses, the larger the system you’ll need, and the higher the total price. However, larger systems typically have a lower cost per watt.1

Equipment Choice:

- Panel Type: Monocrystalline panels are more efficient (15%-22%) and more expensive, making them ideal for roofs with limited space. Polycrystalline panels are slightly less efficient (13%-17%) but more affordable, suiting budget-conscious homeowners.10

- Energy Storage Battery: Adding a battery is one of the biggest factors affecting the total cost. A quality solar battery can cost over $10,000 before incentives.1

Roof Condition: The type of roof (e.g., tile, metal), its angle, orientation, and structural condition all affect the complexity and cost of the installation. If your roof needs repairs or reinforcement, it could add several thousand dollars to the cost.11

2. Decoding Incentives: Maximize Your Savings

Incentive policies are key to lowering the upfront investment in solar and shortening the payback period.

The Federal Solar Tax Credit: The Final Window of Opportunity

The Residential Clean Energy Credit (claimed via IRS Form 5695) allows homeowners to deduct 30% of the total cost of their solar system directly from their federal income taxes.12 For an average system costing $29,970, this translates to a direct saving of approximately $8,991

The most critical piece of information is this: Under a law signed on July 4, 2025, this residential tax credit will be completely eliminated after December 31, 2025, with no phase-out period.12 Your system must be installed and commissioned by that date to qualify.4

State and Local Incentives

In addition to the federal credit, many state and local governments offer incentives, which can include state tax credits (like New York’s 25% credit, up to $5,000), property tax exemptions, sales tax exemptions, and Solar Renewable Energy Certificates (SRECs).14

The Evolution of Net Metering

Net metering allows you to send excess solar power back to the grid and receive credits to offset the cost of electricity you draw from the grid at night or on cloudy days.1 However, this policy is changing nationwide.

In California, for example, the new NEM 3.0 policy has cut the compensation rate for exported electricity by about 75%.17 This change significantly extends the payback period for solar-only systems but also creates a clear incentive for users to add battery storage. This allows them to store excess energy for use during the evening when electricity rates (and export compensation rates) are highest, thereby maximizing their savings.17

3. Ownership Models: To Buy, Lease, or PPA?

You can acquire a solar system in several ways, each with its own distinct pros and cons.

| Metric | Purchase (Cash/Loan) | Lease | Power Purchase Agreement (PPA) |

|---|---|---|---|

| Upfront Cost | High (Requires full payment or down payment) 7 | Low or zero 13 | Zero 20 |

| Long-Term Savings | Highest 7 | Limited 7 | Limited 20 |

| System Ownership | You own it completely 20 | You don’t own it (owned by the lease company) 13 | You don’t own it (owned by the developer) 20 |

| Federal Tax Credit | Claimed by homeowner 7 | Claimed by the lease company 13 | Claimed by the developer |

| Maintenance | Homeowner’s responsibility 21 | Lease company’s responsibility 13 | Developer’s responsibility 22 |

| Property Value Impact | Increases significantly 20 | Does not increase value; may complicate home sale 21 | Does not increase value; may complicate home sale |

| Contract Risks | Loan interest rate risk | Annual price escalator clauses; early termination fees 13 | Potential for loss under low-compensation net metering; long contract terms 23 |

Key Insight: Purchasing is the only way to claim the 30% federal tax credit and achieve the maximum long-term savings. While leases and PPAs have tempting low upfront costs, you give up ownership and crucial tax benefits, and may face hidden annual price escalators in the contract.13

4. Hidden Risks: The Truth You Must Know Before Installing

Before making your final decision, it’s crucial to understand some potential risks. This knowledge will help you choose a reliable installer and protect your investment.

- Roof Damage: This is one of the most common complaints. Numerous users on forums report that improper handling by installers caused cracked tiles or leaks after installation, with installers sometimes shifting blame, leading to costly repair disputes.

Actionable Advice: Clearly define liability for roof damage and repair standards in your contract, and take photos of your roof’s condition before installation begins. - Installer Bankruptcy and Voided Warranties: A solar system typically comes with two warranties: a manufacturer’s warranty (for the hardware) and an installer’s workmanship warranty (for the quality of the installation). If your installer goes out of business, their workmanship warranty will likely become void immediately.29 Even if the manufacturer’s warranty is still valid, you may have to pay another company for the labor to remove and reinstall the warrantied parts.

Actionable Advice: Choose a reputable installer with a long history of business, and give preference to companies that offer third-party insurance to back their warranties. - Property Taxes and Insurance:

- Property Tax: Installing solar does increase your home’s value (a Zillow study found a 4.1% increase). The good news is that over 34 states and territories offer some form of property tax exemption.Be sure to check your state’s specific policy.

- Homeowners Insurance: Your premium may increase slightly due to the added value of your home. It is essential that you inform your insurance company about the installation; otherwise, damage to the solar system from a covered event like a windstorm or hail may not be covered.

Act Now to Secure Your Future

Investing in solar is a major financial decision, and in 2025, the window for that decision is closing rapidly. With the end of the 30% federal tax credit, the cost of hesitation has never been higher.

By fully understanding the average costs, influencing factors, incentive policies, and potential risks, you now have the core information needed to make a wise choice. Our final recommendations are:

- Act Immediately: Don’t wait until the end of the year. As the deadline approaches, the schedules of high-quality installers will become extremely tight.

- Get Multiple Quotes: Obtain detailed quotes from at least three reputable installers and carefully compare their equipment, warranties, and cost-per-watt.

- Ask Tough Questions: Use the risk points mentioned in this guide to ask specific questions of potential installers to gauge their professionalism and reliability.

Seizing this final opportunity in 2025 is not just about locking in energy savings for your family for decades to come; it’s about taking a firm step toward energy independence and a more sustainable lifestyle.

Frequently Asked Questions (FAQ)

How much does a typical home solar system cost in 2025?

Before any incentives, the average installation cost for a standard-sized home solar system in 2025 is between $27,720 and $29,970. After applying the 30% federal tax credit, the net cost is expected to be between $19,404 and $20,979.

Is the 30% federal solar tax credit really ending after 2025?

Yes. Under a law signed on July 4, 2025, the 30% federal solar tax credit for residential properties will be completely eliminated after December 31, 2025, with no phase-out period. Your system must be fully installed and commissioned by that date to qualify.

If my solar installation company goes out of business, is my warranty still valid?

It depends on the type of warranty. The equipment warranty from the manufacturer (for panels, inverters, etc.) typically remains valid. However, the workmanship warranty provided by the installer (covering installation quality, leaks, etc.) will likely be void. This means if a workmanship issue arises, you may have to pay out-of-pocket for a new service provider to make repairs.

Do I need a battery for my solar system?

It's not mandatory, but it's increasingly recommended. In places like California with NEM 3.0 policies that have drastically cut grid buy-back rates, a battery allows you to store excess daytime energy for nighttime use, maximizing your savings. Additionally, a battery provides invaluable backup power during grid outages.

How many solar panels does it take to run a central air conditioner?

This depends on many factors, including the AC's size and efficiency, your local climate, and the wattage of the solar panels. As a rough estimate, a typical 1.5-ton central air conditioner would require about 10 to 12 300-watt solar panels to run consistently during peak sun hours. We strongly recommend having a professional installer perform a precise calculation based on your specific circumstances.

Pingback: Solar Loan vs. Lease: The 2025 Data That Reveals the $29,000+ Winner - EnergySave Pro